1. Introduction#

1.1. About the application#

The Risk Flow application was created primarily to facilitate the work of all risk managers and analysts. Your time is too valuable to waste on formatting tables or headings. Nor should you waste your time on thankless copying of information between different documents. Risk Flow offers you the opportunity to focus only on the content. It takes care of formatting and checking for correct data entry for you. It also takes care of keeping track of defined deadlines. It emphasizes teamwork and the possibility of multiple people working on the same project or parts of it. Your clients will be able to view and participate in the analyses being performed. In addition to inappropriate methods, Risk Flow eliminates the unsecured sharing of files and documents needed to complete risk analyses. Increase the efficiency of your work and your employees and perform risk analyses and asset management simply and, most importantly, securely.

1.2. Main Funcionalities#

User management will provide you with a clear and intuitive environment for managing access and permissions of users who will have access to the platform. In Client Management, you can enter and edit your clients and assign users to them. You can then create asset lists and create risk analyses for registered clients. Completed risk analyses are followed by a creation of a risk treatment plan. To facilitate the development of risk analyses and risk treatment plans, Risk Flow offers a risk catalog containing applicable risks, threats, vulnerabilities, measures, goals and metrics. As part of approval processes, clients then review risk analyses, prepared plans and other documents and add their comments to them. Until the client approves all flow parts, you as risk managers and analysts are still able to modify them. Audit and control activities are a very important part of a properly set up risk management. Within Risk Flow, you can manage the access of internal and external auditors and perform audit processes.

1.3. Licensing models#

Risk Flow has three licensing models, that differ in the amount of available functionality and, of course, in price. This documentation only describes the application differences of the licensing models. For a complete list, including a price comparison, visit

For personal use |

Team |

Enterprise |

|---|---|---|

Unlimited asset management |

Everything in personal license |

Everything in the team license |

Unlimited analyses |

Maximum of 5 active users |

Unlimited number of active users |

Unlimited risk treatment plans |

Maximum of 5 clients |

Unlimited number of clients |

Unlimited flows |

Option to run the instance on dedicated computing resources. |

Customization of generated reports |

Maximum of 2 active users |

Customization application GUI |

|

One active client |

Using your own outgoing mail server |

|

Multifactor authentication |

Using you own domain |

|

Operates in cloud |

Integration with other tools via API |

|

Instances with shared computing resources |

Possibility of customization |

|

Anti DDoS protection with Cloudflare |

Priority support |

|

Support through the ticketing system |

Tip

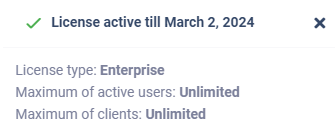

Instance administrators can quickly check the status of their license at

any time by clicking the green Check License button in the left sidebar of the application.

Then they will see information about its status in the right bottom

corner. An example of the license status information for the Team

variant can be seen below.

Information about the active licence.#

1.4. Support#

If you discover any deficiency, you can contact our technical support by submitting a ticket in our helpdesk system. If you have an account, you can access our helpdesk and submit a ticket directly at https://riskflow.freshdesk.com or by sending an email to support@riskflow.freshdesk.com.

1.5. Terms of Use#

By using Risk Flow, you agree to the Terms and Conditions, which can be found at: